New York City is known for its pricey real estate, but some homeowners get an unexpected bargain: Property taxes on some of the fanciest, most coveted properties are often very low — at least relatively.

The flip side? Renters and homeowners in lower-income neighborhoods end up carrying a lot of the burden.

Take, for example, a $5.4 million brownstone in Brooklyn’s Park Slope. Its annual property tax bill is around $12,000 — about 0.2 percent of the home’s overall worth. Now compare that with the $7,500 tax bill for a $780,000 home in the Bronx. The cheaper home has an effective property tax rate almost four times higher.

Both bills are lower than in much of the suburbs, where property taxes for less valuable homes routinely top $25,000.

“I don’t think it’s fair,” said Mark Young, 60, who owns the brownstone.

Nearly everyone in New York agrees with him. Under the city’s property tax system, which is broadly criticized as opaque and unjust, lower-income homeowners and owners of big apartment buildings pay more relative to the value of their properties. Several mayors have unsuccessfully pledged to mend the resulting racial and economic disparities.

Now, a decision from the state’s highest court has made it much more likely that the city will be forced to make changes. The decision was procedural, essentially allowing the case to move forward. But the court rejected some of the city’s methods that have led to the unevenness.

In response to questions about the case, a spokesman for the city’s Law Department said the city was still figuring out its next steps, adding that the best way to improve the tax system was through the State Legislature. But Liz Garcia, a City Hall spokeswoman, said in a statement that “the city’s property tax system has been unfair, particularly for Black and Brown homeowners.”

“Mayor Adams has been clear that it needs reform,” she said.

Revenue from property taxes is extremely important to New York: The city draws in about $32 billion each year in property tax revenue, according to recent figures, amounting to about 30 percent of the overall $110 billion budget.

How the city raises that money, however, frustrates Carmen Daniels, 74, a retired teacher and administrator who bought a three-bedroom home in East New York in 1998.

Ms. Daniels noted that she pays considerably higher taxes relative to people in wealthier parts of Brooklyn, like Park Slope and Prospect Heights. She asked, “Why is it our taxes in the lower-income neighborhoods, people of color, why are the taxes more” than theirs?

A Deal on a Brooklyn Brownstone?

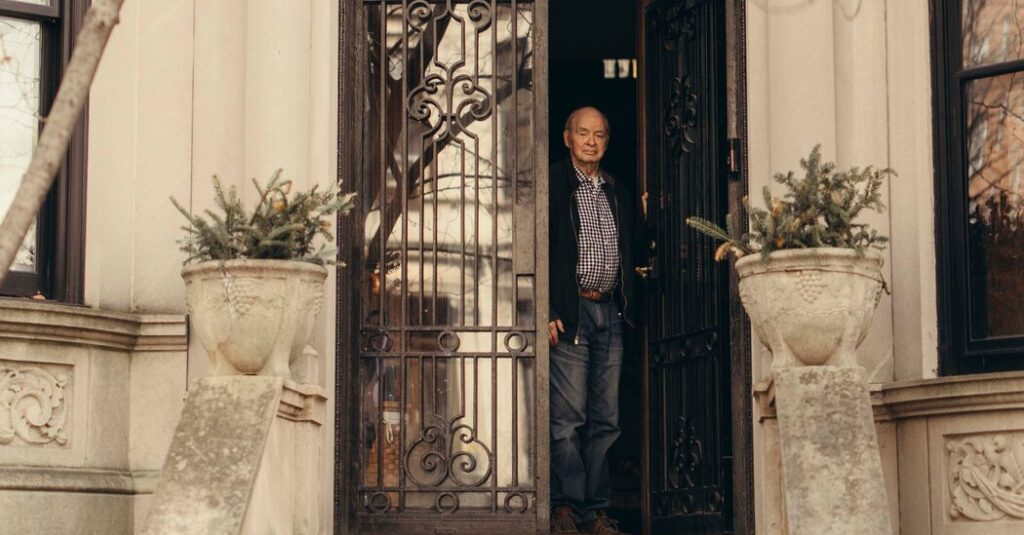

Richard Erde, 83, bought his home in Park Slope in 1980 for about $140,000. He said he had “watched the house appreciate tremendously” — his home today is valued by the city at nearly $6.5 million.

His roughly $15,000 property tax bill, however, doesn’t reflect that growth.

“It’s much less than, for instance, it would be if I lived in the Hamptons,” he said.

Officials in New York City follow a familiar formula to determine a tax bill. First, the city estimates a home’s market value. Then, it comes up with an “assessed value,” which is a smaller portion of the overall market value. Finally, it applies a tax rate to the assessed value to calculate how much the owner owes.

But the state sets limits on how quickly assessed values can go up. This benefits people like Mr. Erde in neighborhoods like Park Slope, where market values have skyrocketed, because it essentially means their tax bills won’t rise as fast as the market value of their homes.

A change in that system could be a hardship for Mr. Erde, who lives on a fixed income.

A higher tax bill would “cause us to adjust in some way our weekly, monthly budgeting for things,” he said.

People like Ms. Daniels are in a different situation. Home values in neighborhoods like hers have grown at a slower rate, meaning that even though assessed values are increasing, they rarely hit the limit.

Over time, that creates gaps between neighborhoods: Homeowners in Staten Island, much of the Bronx and parts of Brooklyn and Queens end up paying much more relative to the value of their homes compared with those in well-to-do neighborhoods.

Ms. Daniels’s $3,000 to $4,000 annual property tax bill may appear low. But it is effectively three times higher than Mr. Erde’s.

Condo vs. Rental

The gulfs can seem even more staggering when comparing co-op and condo buildings with rentals.

For example: A penthouse condo in Central Park Tower, advertised as the “tallest residential tower in the world,” sold in January for around $115 million. But the city valued the unit at only about $10 million in 2024, and valued the entire 179-unit building at $308 million.

The reason is a state rule that forces the city to value co-op and condo buildings as if they were rentals. But the city often uses rent-stabilized buildings in those comparisons, which means the condos and co-ops are valued too low, according to the court ruling. The court said the city should compare those buildings to market-rate apartments.

Rose Ricci-Mullen, 54, who owns a co-op apartment in Park Slope, is aware that her taxes are relatively low. She pays 30 percent of the roughly $11,000 in property taxes owed for her entire three-unit building, which was valued at close to $1.9 million.

Ms. Ricci-Mullen, a school librarian, said she would not have a problem with making the system more equitable. She said it was important to have a “tax base that makes it so everybody gets services.”

But if her taxes were to go up, she added, “I would need advanced warning, just because we’d have to budget around it.”

Compared with the owners of co-ops and condos, the owners of rental buildings pay much higher taxes. Damon Pazzaglini, chief operating officer of Fetner Properties, a real estate company, said taxes are the biggest component of a building’s expenses. As they rise, building owners typically pass on the cost to renters.

“This is one of the biggest drivers of high rents in New York that exists,” Mr. Pazzaglini said.

In many cases, apartments might not be built at all because the taxes are so high, Mr. Pazzaglini said. For example, he said that none of three developments Fetner is constructing — two in Long Island City and one on the Upper West Side, totaling almost 700 rental apartments — would have been built without a tax break to reduce some of the property tax costs.

“Simply, that land would be sitting fallow right now,” he said.

State lawmakers let such a tax break, known as 421a, expire in 2022 and the pace of rental construction has plummeted.

Flee for the Suburbs? Good Luck.

New Yorkers in search of affordable housing often cast their eyes on the suburbs. Many housing advocates would agree that the tax system is simpler in some suburbs. But that doesn’t necessarily mean that homeowners pay less.

Rachel Goldberg, 47, and her husband left New York City for South Orange, N.J., in search of “beauty and peace” and a place to raise their children, she said.

Their annual tax bill, however, is more than $25,000, she said. Her home was valued at close to $834,000 in 2023, according to county records. Ms. Goldberg, a school superintendent, said the couple may need to move again if the taxes keep growing, “which is sad.”

“I would love to say we’d be here for the next 20 years,” she said.